A new report outlines the financial impact of Medicaid expansion in Texas to the state’s overall budget. The report was written by Randy Fritz, John R. Pitts, and John R. Pitts, Jr. and sponsored by Episcopal Health Foundation.

Medicaid funding in Texas is a combination of federal, state, and local revenue. For every $100 spent on the program to provide health benefits to children, pregnant women, individuals with disabilities, and the elderly, the federal government contributes just over $60 (not counting a temporary increase related to the pandemic).

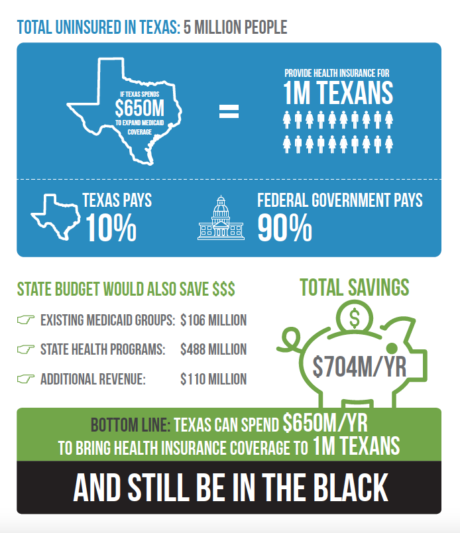

Texas has the opportunity to increase the federal contribution to 90% for a group of non-disabled adults who currently do not qualify for any other form of health insurance assistance. As shown by the experience of other states, such as Indiana, the state has flexibility in how to take advantage of that opportunity, including the creation of a plan that aligns with state priorities such as personal responsibility, budget certainty, and benefits more in line with the commercial market.

Because the state is responsible for the 10% share, how would that decision affect the state budget, particularly the programs in which state general revenue pays for health care services? Specifically, would new general revenue have to be allocated or would the program pay for itself or even generate a positive financial result? In 2013, the state answered that question with this statement in a fiscal analysis: “…potential savings and revenues would more than offset the general revenue cost, resulting in a net positive fiscal impact.”

The magnitude of this positive impact, and its underlying sources, has not yet been fully documented—until now. This document compares a fully operational 90% federally financed program with the state’s current budget and its state-funded health programs and commitments.