Two new EHF research reports show many Texans lack a clear understanding of the most basic health insurance terminology and have difficulty understanding how their plans work. This new evidence demonstrates an urgent need to educate consumers so they can make better choices about health insurance.

In the first report, EHF and the Rice’s Baker Institute for Public Policy found approximately 25% of Texans say they lack confidence in understanding basic health insurance terms like “premium,” “co-payment” and “deductible.” Researchers found uninsured, low-income and Hispanic Texans were the least likely to understand these basic terms.

The report shows at least half of those who are uninsured said they didn’t fully understand five of seven basic terms – premium, deductible, co-payment, co-insurance, maximum out-of-pocket spending, provider network and covered services. The rates of lack of confidence for uninsured Texans were nearly double that of those with health insurance.

See easy-to-use definitions of health insurance terms

“This research shows that understanding the key parts of a health insurance plan can be tough, especially for the uninsured,” said Elena Marks, EHF’s president and CEO and a nonresident health policy fellow at the Baker Institute. “These numbers illustrate the continuing need to offer education and outreach targeting the uninsured so they can better understand their health insurance options.”

Researchers found other population groups that are more likely to be uninsured also had difficulty understanding health insurance terms. More than 40 percent of Hispanics in Texas expressed a lack of confidence in understanding all of the terms, compared with much smaller percentages for whites and blacks.

The report also found that low-income Texans were significantly more likely to have less confidence in understanding health insurance terms than those with higher incomes.

Of the five health insurance terms relating to costs, 25 percent of all adult Texans who were surveyed – both insured and uninsured – said they lacked confidence in understanding the concepts of “premium,” “deductible” and “co-payment.” More than 35 percent of Texans said they didn’t understand “maximum out-of-pocket expenses,” and 45 percent didn’t understand “co-insurance.” In addition, 30 percent of Texans said they lacked confidence in understanding the terms “provider network” and “covered services.”

“Even among those with insurance, many lacked confidence in aspects of employer-provided insurance that have changed dramatically over the past several years,” Marks said. “Workers are paying larger portions of premiums, deductibles and co-pays. They need to fully understand how these changes can influence their out-of-pocket spending on health care.”

Insured Texans who bought their own health insurance less likely to understand terms, plan

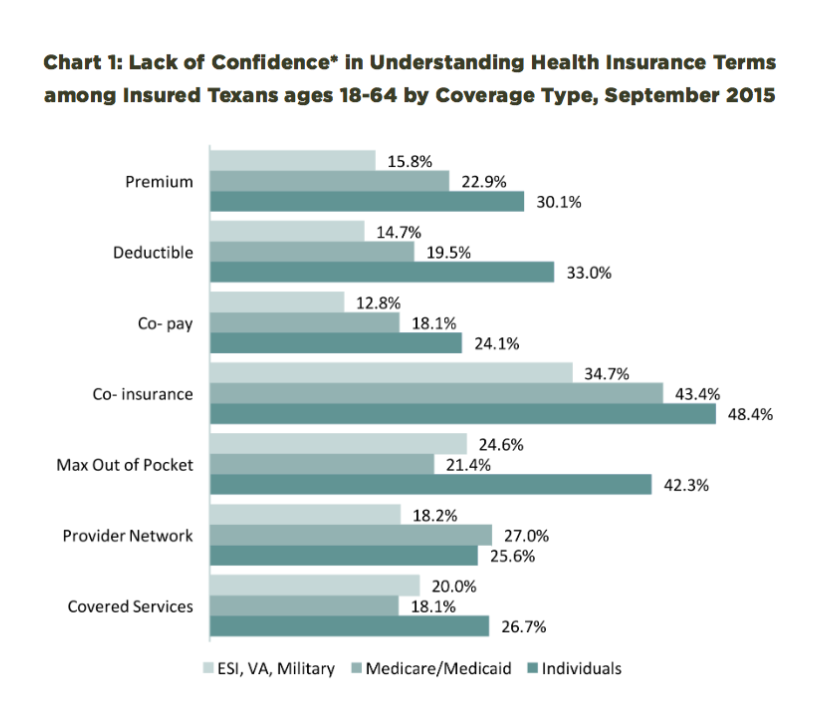

The second EHF research report showed Texans who bought their own health insurance were less likely to understand basic terms and how to use their plans compared with those who have Medicare, Medicaid or employee-sponsored health insurance.

The report discovered that Texans who bought individual plans were far less likely to understand basic health insurance terms like “premium,” “co-payment” and “deductible.”

For example, 25 percent of Texans with employee-sponsored health insurance said they lacked confidence in understanding the term “maximum out-of-pocket expenses.” But more than 42 percent of Texans who bought their own health insurance plans said they didn’t understand the same term.

“The unfortunate irony is that those with individual health insurance plans are the least likely to understand the basic terms, but they have the greatest need to understand them,” said Marks. “This group has to choose from a variety of health insurance options and pay much more of the cost of their insurance. It’s critical that they understand what they are buying.”

The report found Texans who bought their own health insurance also had more difficulty understanding how to use their health plans. More than half (51 percent) said that they lacked confidence to understand how much it would cost to go to healthcare providers outside of their plan’s network. Nearly half (46 percent) said they didn’t understand what counts as preventive services, many of which are covered by health plans at no additional cost.

Researchers found that Texans with Medicare, Medicaid, military and employee-sponsored health insurance had difficulty understanding basic health insurance terms and how to use their plans; however, their lack of confidence rates were around one-third lower than those for Texans who purchased individual health insurance.

Marks said this research highlights the urgent need to emphasize the importance of consumer literacy in the national conversation about health insurance.

“It’s important for all Americans to better understand this complex system so that they can make the best decisions about health insurance and health care choices for themselves and their families,” Marks said. “Those who’ve worked diligently to expand enrollment in health coverage must help the newly insured understand their plans.”

How well do you know health insurance terms? Easy-to-understand definitions can help

Be honest. If you had to take a test on knowing the ins and out of health insurance terms, would you pass? Could you teach others about the terms?

“An important first step for us to begin the conversation about health insurance literacy is to first understand these terms in everyday language,” says Shao-Chee Sim, EHF’s VP for applied research.

Sim says the definitions provided by healthcare.gov can be very helpful:

Premium: The amount that must be paid for your health insurance or plan. You and/or your employer usually pay it monthly, quarterly or yearly.

Deductible: The amount you owe for covered health care services before your health insurance plan begins to pay. For example, if your deductible is $1,000, your plan won’t pay anything until you’ve paid $1,000 for covered services.

Co-pay: A fixed amount (for example, $15) you pay for a covered health care service, usually when you get the service.

Co-insurance: Your share of the costs of a covered health care service, calculated as a percentage (for example, 20%) of the allowed amount for the service. You pay coinsurance after you’ve met your deductible. For example, if the health insurance plan’s allowed amount for an office visit is $100 and you’ve met your deductible, your 20% co-insurance payment would be $20. The health insurance plan pays the rest.

Maximum annual out of pocket spending: The most you’ll have to pay for covered services in the annual policy period. After you reach this amount, your health plan will pay 100% for covered essential health benefits.

Provider network: A list of the doctors, other health care providers, and hospitals that a plan has contracted with to provide medical care to its members. These providers are called “network providers” or “in-network providers.” A provider that hasn’t contracted with the plan is called an “out-of-network provider.”

Covered services: Your health insurance policy is an agreement between you and your insurance plan. The policy lists a package of medical benefits such as tests, drugs and treatment services. The insurance plan agrees to cover the cost of certain benefits listed in your policy. These are called “covered services.”

The website www.healthcare.gov/glossary/ provides definitions of many more health insurance terms. Sim suggests also visiting the website of the health insurance plan you have selected, speak to the enrollment navigator, or even ask staff at the doctor offices when you do not understand certain health insurance terms.

“To the newly insured population, understanding these terms is a very important first step in becoming informed healthcare consumers in your community,” Sim said. “These numbers also illustrate the need to offer education and outreach that targets the uninsured. It’s critical that they better understand these terms, so they can better understand their possible health insurance options.”