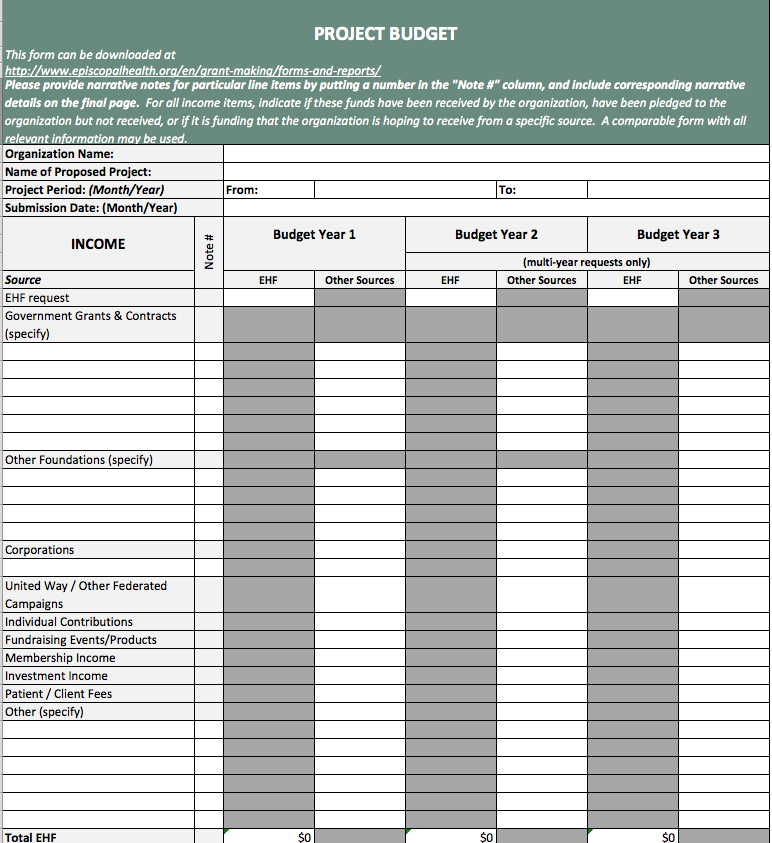

In response to grantees’ request, we have developed a budget template form to use when reporting your organization’s project/program budget. You may download it in Microsoft Excel format. If you already prepare a project or program budget that is comparable to this format, feel free to submit that instead of this form.

Click here or on the form above to download the Budget Template form

This form must be submitted with your application.

On the last page, please give a brief narrative description of all items listed in the income columns as well as those listed in the expense columns.

For all income items, please indicate in the narrative if these funds have been received by the organization, have been pledged to the organization but not received, or if it is funding that the organization is hoping to receive from a specific source.

For all expense items, indicate if the expense is a direct cost or an indirect cost and the formula used to calculate the specific expense.

Direct costs are expenses that are specifically attributable to the project or program. Examples of direct costs are salaries for program staff or rent for space for program activities.

Indirect costs are those expenses that are not directly attributable to a specific program. Such costs are often shared among programs and include those costs that are necessary to the overall functioning of an organization. Per EHF’s policy, we will consider funding indirect costs only for restricted grant budgets. Indirect costs are calculated based on expenses for salary (for personnel) and fringe benefits. For organizations whose annual budget is $500 million or less, the indirect cost rate may not exceed 20%. For organizations whose annual budget is $500 million or more, the indirect cost rate may not exceed 10%.

Applicants requesting indirect costs should include such costs as a line item within the project/program budget and demonstrate how the amount being requested is calculated. This may include showing how specific indirect costs are allocated or providing evidence of a negotiated indirect cost rate.