EHF’s analysis found that almost 7 in 10 Texas enrollees in 2018 were returning consumers (69%). More than 779,000 enrollees returned in the 2018 ACA enrollment period compared to 770,000 the previous year.

“These numbers show that even with all the obstacles and confusion, Texans want health insurance and they’ll buy it if it’s affordable,” said co-author Elena Marks, EHF’s president and CEO. “The increasingly high rates of returning enrollees shows that a majority of Texans who received health coverage through the ACA want to keep it.”

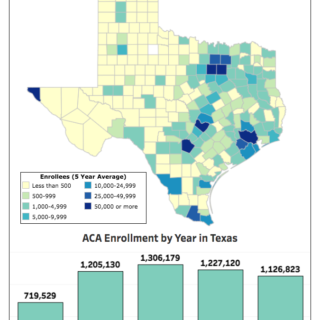

The analysis found that the overall number of Texans enrolled in ACA health insurance dropped slightly to 1.1 million in 2018 compared to 1.2 million in 2017. However, along with confusion about the future of the ACA, the enrollment period for 2018 was cut in half from three months to six weeks compared to 2017.

As in the previous ACA enrollment periods, the vast majority of Texas enrollees for 2018 (76%) have household incomes between 100% and 250% of the Federal Poverty Level (FPL) — $12,140 – $30,350 for individuals/ $25,100 – $62,750 for a household of four.

The analysis found that more than 8 in 10 (86%) of ACA enrollees in Texas receive federal financial assistance to help pay for their ACA health insurance premiums. Texans who earn less than 100% of the FPL ($12,140 for individuals/$25,100 for household of four) are not eligible for financial assistance because the ACA’s plan for covering this low-income group was through Medicaid expansion. Texas lawmakers have opted not to expand Medicaid or create a similar program that would provide coverage.

In 2018, researchers found that federal financial assistance in the form of tax credits cut monthly premium costs for Texas enrollees by an average of 85% — from $543 to $79. In 2017, federal financial assistance cut monthly premiums by only 79% — $403 to $85.

Researchers found the increased amount of financial assistance in Texas came as the U.S. Department of Health and Human Services ended cost sharing reduction payments (CSRs) to insurers in 2018. That caused health insurance plans to increase premiums to cover the costs of losing those payments. In Texas, premium costs increased 35%, the analysis shows. However, since the amount of financial assistance is based on a formula directly linked to premium costs, federal financial assistance also increased.

“While most Texans who signed up for ACA health insurance were shielded from the direct impact of those premium increases, not all Texans were so lucky,” said Shao-Chee Sim, co-author and EHF’s vice president for applied research.

Sim says about 14% of Texas enrollees with moderate incomes greater than 400% of the FPL ($48,560 for individuals/$100,400 for household of four) didn’t qualify for financial help and paid higher premium prices because of the federal decision.

Other findings from EHF’s analysis of 2018 Texas ACA enrollees:

- 55% are women

- 87% live in urban areas

- 24% are adults ages 55 to 64

- 21% are adults ages 45 to 54

- 64% selected a Silver health insurance plan

Texas remains the state with the highest uninsured rate in the nation (17%) and the most uninsured residents (4.7 million).

“Lawmakers in Washington and Austin need to look for different ways to expand health insurance to these families,” Marks said. “Medicaid expansion alone could help more than 700,000 uninsured Texans get coverage.”

EHF’s analysis was co-authored by Sim, Marks, Robiel Abraha and Sheryl Barmasse. The report provides an overview of the experiences of the past five ACA marketplace open enrollment periods in Texas. Data and figures presented in the report are based on analysis of 2018 data published by the Centers for Medicare & Medicaid Services (CMS) compared with data from Office of Assistant Secretary for Planning and Evaluation (ASPE) for previous open enrollment periods.